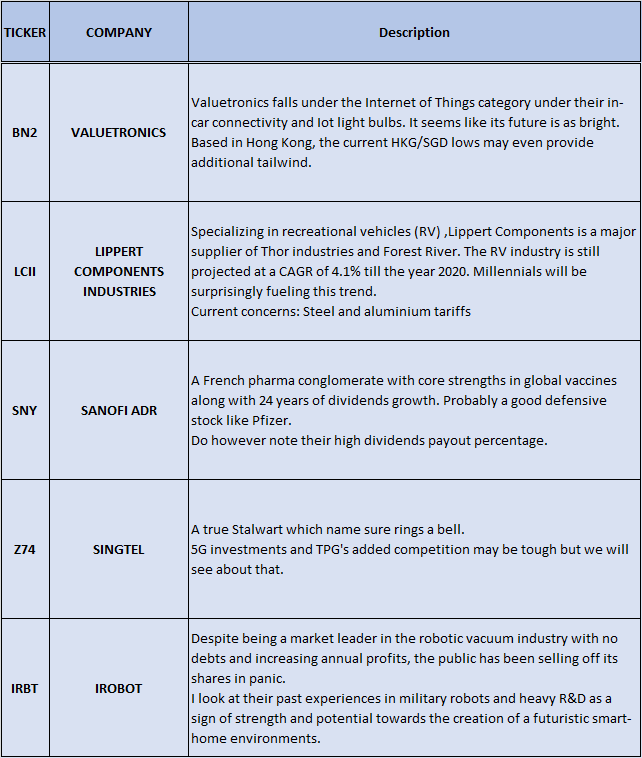

Below is a brief overview of the companies in my portfolio, with an overall and average estimated 3.16% of annual dividends after tax. Deeper analysis will be shared in the next few posts for those who are interested. Cheers.

Disclaimer:

Writings made in this blog are based on opinions and findings. The writer/author of this blog is not liable on any liabilities or losses that arises from the contents of this blog

Information shared in this blog does not guarantee completeness or accuracy.

Subjects, demographics, currencies, shares or companies mentioned in this blog does not indicate as investment recommendations but solely for discussion and sharing purposes.

Beware, telco set for big fall.

ReplyDeleteHi,

ReplyDeleteSorry for the late reply.

Yes, I agree and have reduced my position. "Unable" to sell the rest as they are at paper loss.

Having a stake in Amaysim will boost Singtel's customer pool in Aussie. Will see how it goes to decide further actions.